Download Ready to use UAE VAT Tax Invoice Excel Template. Simply add your details and start using it. The VAT will be implemented in UAE from 01 Jan 2018. We have created the UK VAT Dual Currency Invoice excel template with predefined formulas that will help you to issue the invoice with 2 currencies. One is Sterling Pound and another currency whichever is applicable. A dual currency invoice is prepared when the goods or services supplied are from a foreign location or in foreign currency.

- Yes, even if you don’t have a registered account, our invoice generator offers a customizable ready-made invoice template to create & instantly download the PDF copy of your Pakistan invoice or save the information to use later. How do I send a Pakistan VAT/No VAT invoice? Send the created PDF Pakistan invoice electronically or print it.

- Invoice with tax calculation. Set the tax rate and calculate the tax automatically on the sale of your products or services with this basic, accessible invoice template for Excel. This invoice with tax calculation template is ideal for small to medium-sized businesses.

- VAT stands for Value Added Tax and the invoice mentions the details about how much tax is to be applied for a particular item or the service rendered. The VAT invoice is a document that notifies an obligation to make a payment.

To help you with this we have given you free Vat Invoice Template Uk in Excel format – make sure you choose the correct one as they are different depending on whether you are VAT registered or not. Please note that these templates are only suitable for UK Emily Coltman FCA, Chief Accountant to FreeAgent – which provides the UK’s market-leading online accounting system specifically designed for small businesses and freelancers – gives her top tips for what to include on your invoice template. an invoice with any mention of VAT on it however now that I’m VAT registered and sell to customers in the UK, EU & Rest of the World do I have to have a separate invoice template for those customers.

From reading HMRC rules it states that I zero rate The Invoice for VAT Registered Limited Companies Classic Template (UK) mobile app includes a detailed classic invoice that completes invoice calculations. The app is intended for business with VAT Registered Limited Companies in the United Kingdom. It’s easy to create an invoice that includes your business details Should you wish to add a calculation for sales tax or VAT (UK), insert a formula field. First, click in the next cell down and choose Field from the Insert menu. Then, click the For first timers, check out our easy-as-pie Vat Invoice Template Uk, which is a simple fill-in-the-blanks and the rate. Should I put VAT on my invoice? A common question, and one that never fails to stump new freelancers. For a more detailed explanation .

The free online invoice creator can create a invoice, send it to the recipient and even track payments for you. Below we have listed 9 best online invoice creator invoice templates include, Sales Invoice Template, UK Invoice Template no VAT From 1st April, suppliers who offer Prompt Payment Discounts their invoice templates to ensure that they comply with the new rules. An example of a PPD would be “Discount of 5% for payment within 14 days”. The previous rules stated that VAT Freelancer’s Question: What is the best invoice format that works for both freelancers templates at the Microsoft Office website that make a good starting point. The one final point for you to consider (if you haven’t already) is in relation to VAT In addition, I’ll give you 10 beautiful invoice templates you can customize and use immediately entries and check what the rules are. For example, for UK businesses, if your company is VAT registered HMRC rules about Vat Invoice Template Uk say that you must .

Vat Invoice Template

VAT Invoice Template is an excel template in compliance with GCC VAT Law. You can issue VAT invoice for all 6 GCC Countries; Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and UAE easily and efficiently using this template.

All 6 GCC countries have signed the agreement for the introduction of VAT throughout the GCC in 2018.

Businesses operating in GCC countries have to prepare for compliance with the GCC VAT Law 2018 in time.

We have created a ready to use VAT Invoice Template in Excel. The user just needs to select his country and can start issuing VAT compliance invoices to their customers.

Click here to Download VAT Invoice Template for Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and UAE.

You can also download other UAE centric Accounting Templates like UAE Invoice Template, UAE Invoice Template in Arabic, UAE VAT Debit Note and UAE VAT Credit Note etc.

Before proceeding to the template contents, you need to select your country from the box given beside the template. See image for reference:

When you select the country, it will automatically change the currency in all cells of the template.

Now, let us discuss the contents of VAT Invoice Template in detail.

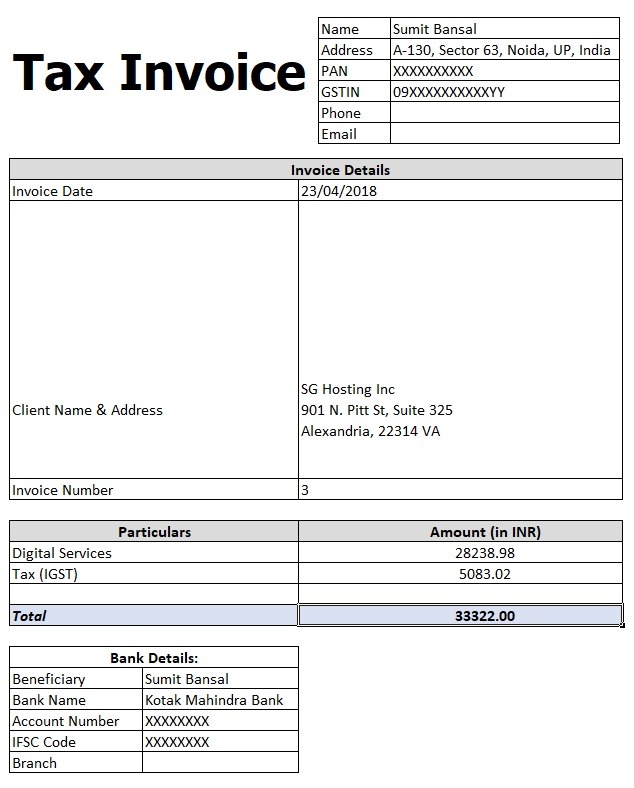

Content of VAT Invoice Template

This template consists of 2 worksheets.

- VAT Invoice Template

- Database Sheet (Customer Sheet)

Database sheet contains the list of the names of your customers. This list is used for creating the drop-down list in customer details section of VAT Invoice Template.

The invoice Template consists of 4 sections:

- Header Section

- Customer Details Section

- Product Details Section

- Other Details Section

1. Header Section

The header section contains the company logo, company name and heading of the invoice ” Tax Invoice”.

2. Customer Details Section

Customer Detail section programmed and referenced to database sheet with data validation and Vlookup function.

You can select the name of the customer from the drop-down list.

When you select the customer names, the template automatically updates other details of customers in the relevant cell.

These details include address, phone, email and customer id.

Vat Invoice Format In Excel Sheet

The right-hand side you need to enter the invoice number, invoice date. The due date for payment which is set to 30 days from the date of invoice will appear automatically. Then comes your VAT Registration Number.

3. Product Details Sections

Product details section consists of columns of Description, Quantity, Unit Price and Amount.

The formulas used here are simple mathematical computations.

Quantity X Unit Price = Amount.

At the end, the subtotal line is given.

4. Other Details Section

Other details section consists of Amount in words, Terms & Conditions, VAT computations @ 5%.

In addition to that below are given space for Company seal, signature box and “Thank you” message business greeting.

It automatically computes the 5% VAT of the invoice amount and sums up the final total.

We thank our readers for liking, sharing and following us on different social media platforms.

Vat Invoice Microsoft

If you have any queries please share in the comment section below. We will be more than happy to assist you.